As rumors of the Pepsi discontinuation persist, the more intriguing story is the white-gold version with a meteorite dial, sometimes nicknamed the “Superman” because part of the watch comes from outer space. Despite its rare dial and the soaring price of gold, the watch has essentially flatlined on the secondary market, even after rumors of its discontinuation.

To hear the luxury media say it, it’s all but official that Rolex is axing the GMT-Master II “Pepsi.” The reason is unclear, but the headlines all point to a single Watchpro report saying that “Rolex has informed its authorised dealers there will be no more deliveries of the steel GMT-Master II with red and blue Pepsi bezel.”

Rolex could simply be upgrading its best-selling dual-time watch. The bezel could be made from a new material that is more complex to produce but has fewer failures, along with a new caliber featuring a quick date set, eliminating the need to turn the hour hand repeatedly. If it exists, such a version could prove kryptonite for current Pepsi prices.

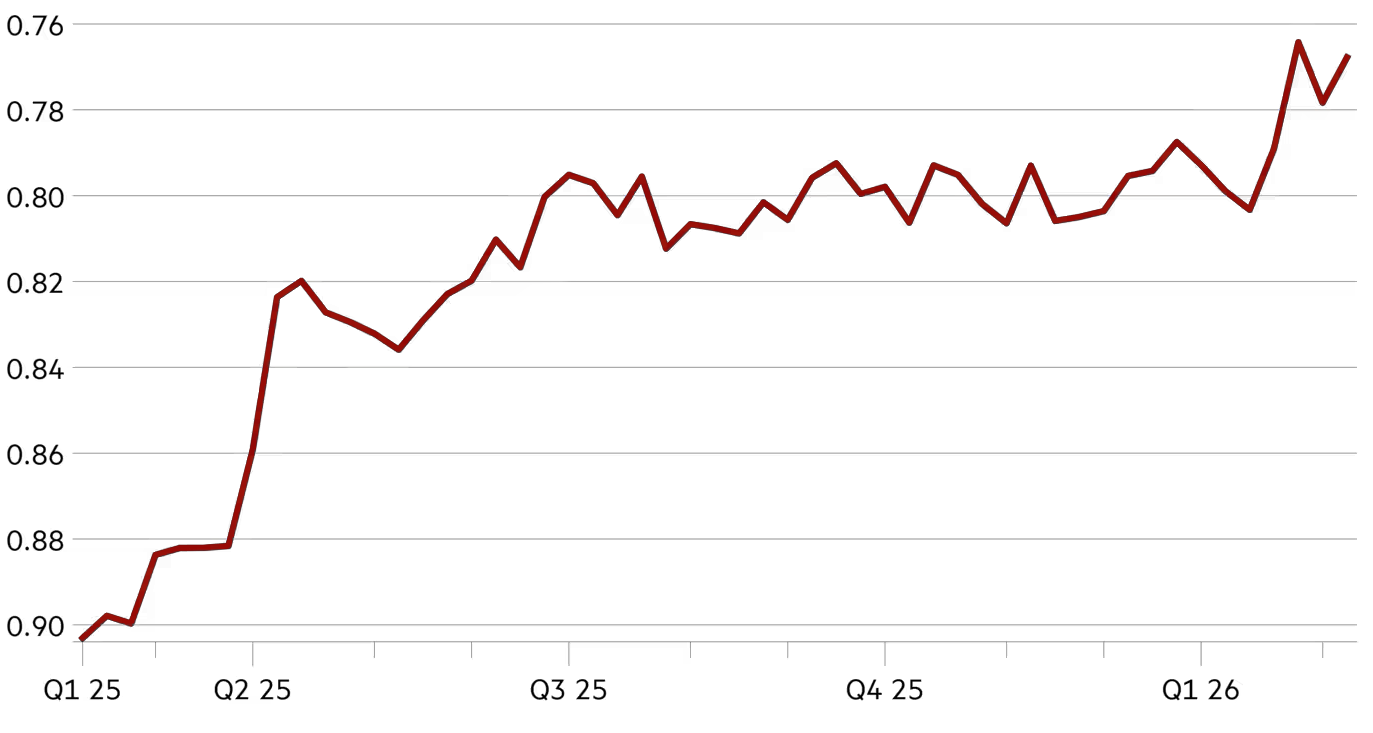

While the steel version today commands a 95% premium, based on Chrono24 data reflecting sold prices on the platform, the meteorite dial barely hovers above retail at 3%. Granted, the retail prices are not in the same league, but that 92-point gap is still hard to explain. By comparison, the white-gold Daytona with a meteorite dial commands a 131% premium despite its already high MSRP and no rumor of discontinuation.

Still, the Watchpro report refers specifically to “steel,” raising the question of whether precious-metal versions remain. Asked to clarify, Rob Corder, editor-at-large at Watchpro, said the information he received referred only to the steel version. “The AD who told me there would be no more deliveries of the Pepsi was referring to the steel edition. Regrettably, we did not discuss the white gold,” he said.

If the Pepsi were truly discontinued in all metals, prices for the meteorite version should rise. But the market, at least for now, seems unsure about Superman’s fate.