From half-size to full status: Rolex’s new CPO box arrives.

Rolex’s redesigned Certified Pre-Owned boxes are reaching official retailers. Coronet reported in January that the brand was preparing to release resized packaging for CPO watches to match the dimensions of its new presentation box.

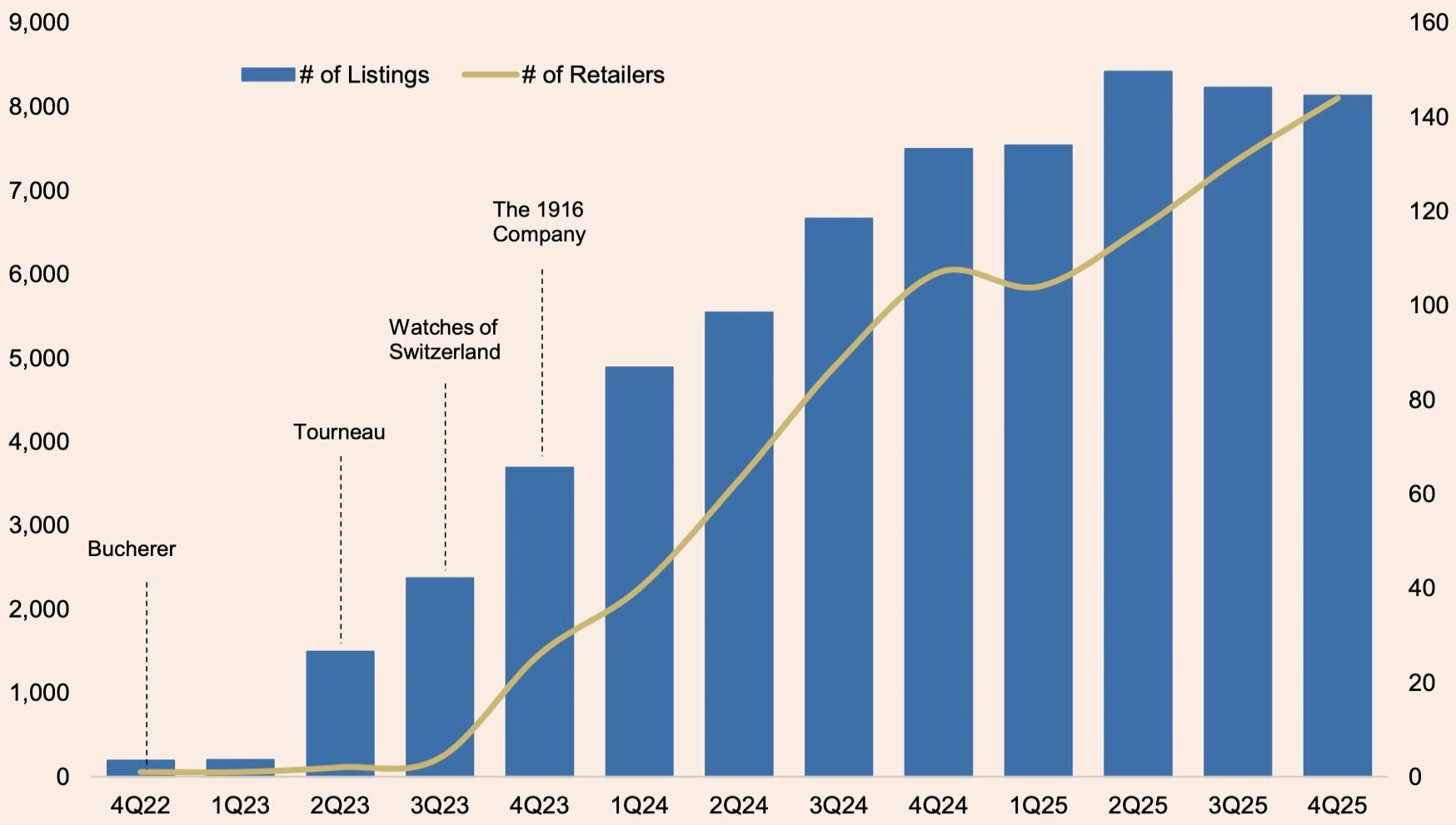

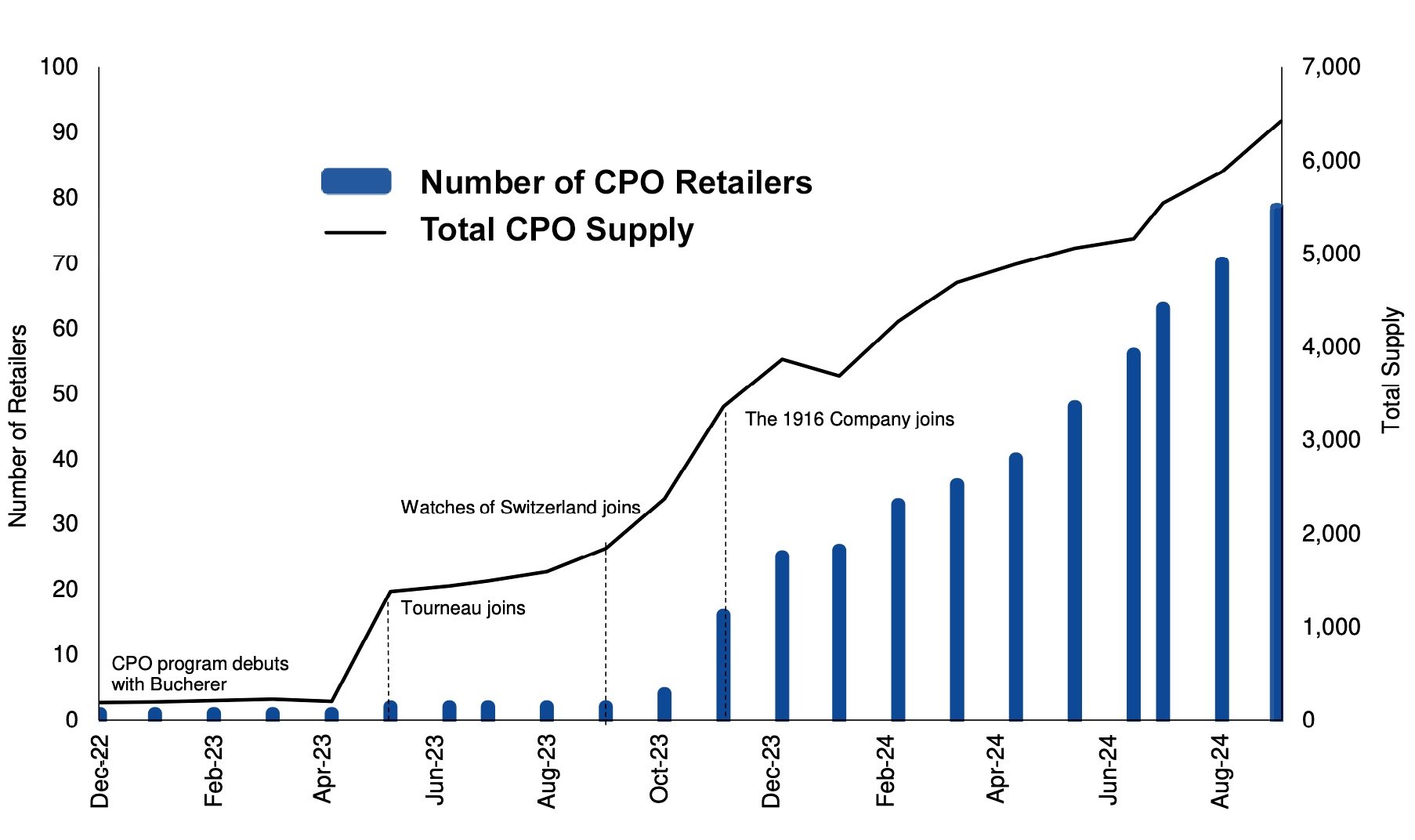

Since launching its certified pre-owned program in late 2022, Rolex has used beige boxes roughly half the size of its standard green presentation, a choice aligned with its sustainability messaging while stopping short of the full new-watch experience.

But last year, Rolex also introduced updated eco-friendly boxes for new watches, built with a structure composed of 45% wood, compared with the previous version, which was 92% plastic. The same material is now being applied to CPO boxes as the program continues to grow despite a volatile economy.

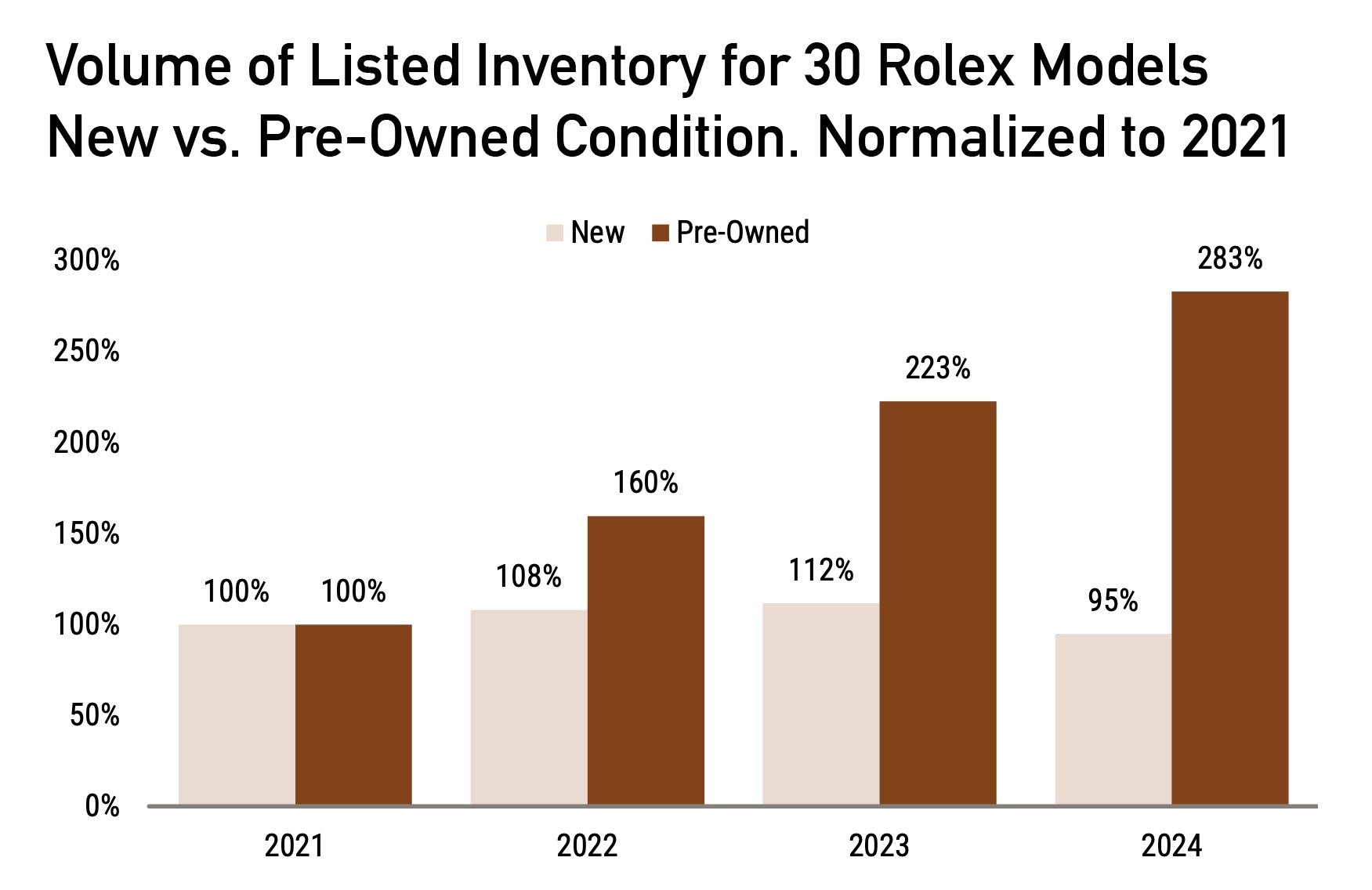

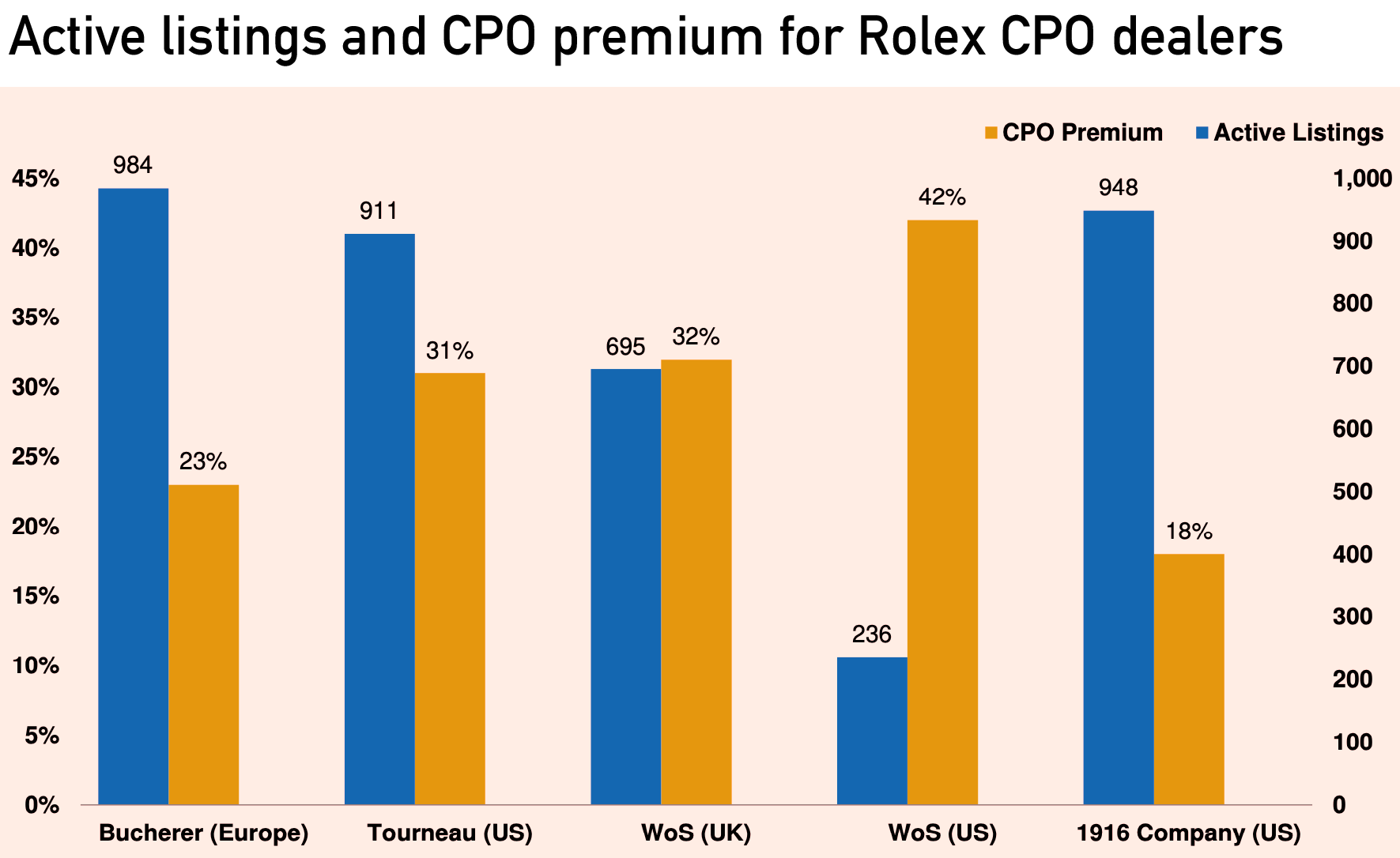

By increasing the size of its beige CPO boxes to match the green ones, Rolex is narrowing the psychological gap between new and pre-owned. CPO clients are often first-time buyers paying a sizable premium, not only over retail but also over non-CPO listings. According to WatchCharts, the global median CPO premium stands at 28% compared with non-CPO pre-owned watches.