(Photo credit: Rolex)

After years of post-pandemic rebounds and record-breaking value growth, the Swiss watch industry shipped almost 10% fewer watches in 2024 than in 2023. Swiss mechanical timepieces, the crown jewel of the industry, were hit hardest, down 14.6% — all that according to recent data provided by the Swiss Federal Customs Administration.

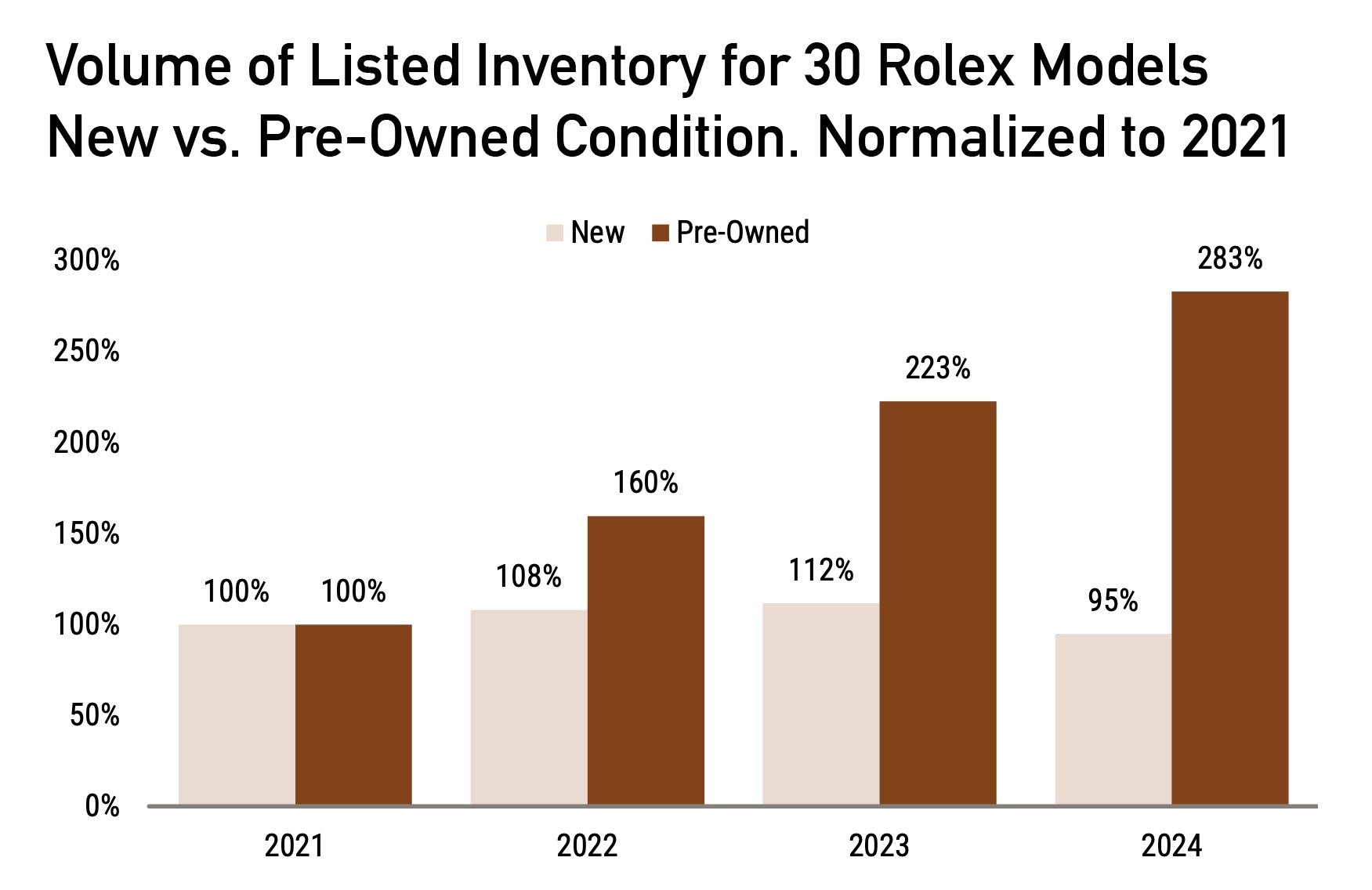

Despite the broader slowdown, Rolex is taking a contrarian approach by ramping up production. Starting in early 2025, Rolex will activate new production lines at its acquired site in Romont, with plans to expand its workforce to 250 employees at the site. In less than five years, Rolex will launch its new mega-manufacture in Bulle employing over 2,000 people. Rolex’s bold bet as the industry retreats could exacerbate the balance of power.

Swiss watch exports by units and value. (Credit: FH)

While the Swiss industry's decline in volume is striking, the value of Swiss watch exports tells a more nuanced story. Total wristwatch exports in 2024 generated CHF 24.82 billion, marking just a 2.8% decline from the previous year, the latest sign of the industry's shift toward exclusivity and premiumization.

Despite a sharp 9.4% drop in the number of watches exported, the relatively modest decline in export value reflects the Swiss watch industry’s evolving strategy: fewer watches, higher prices.