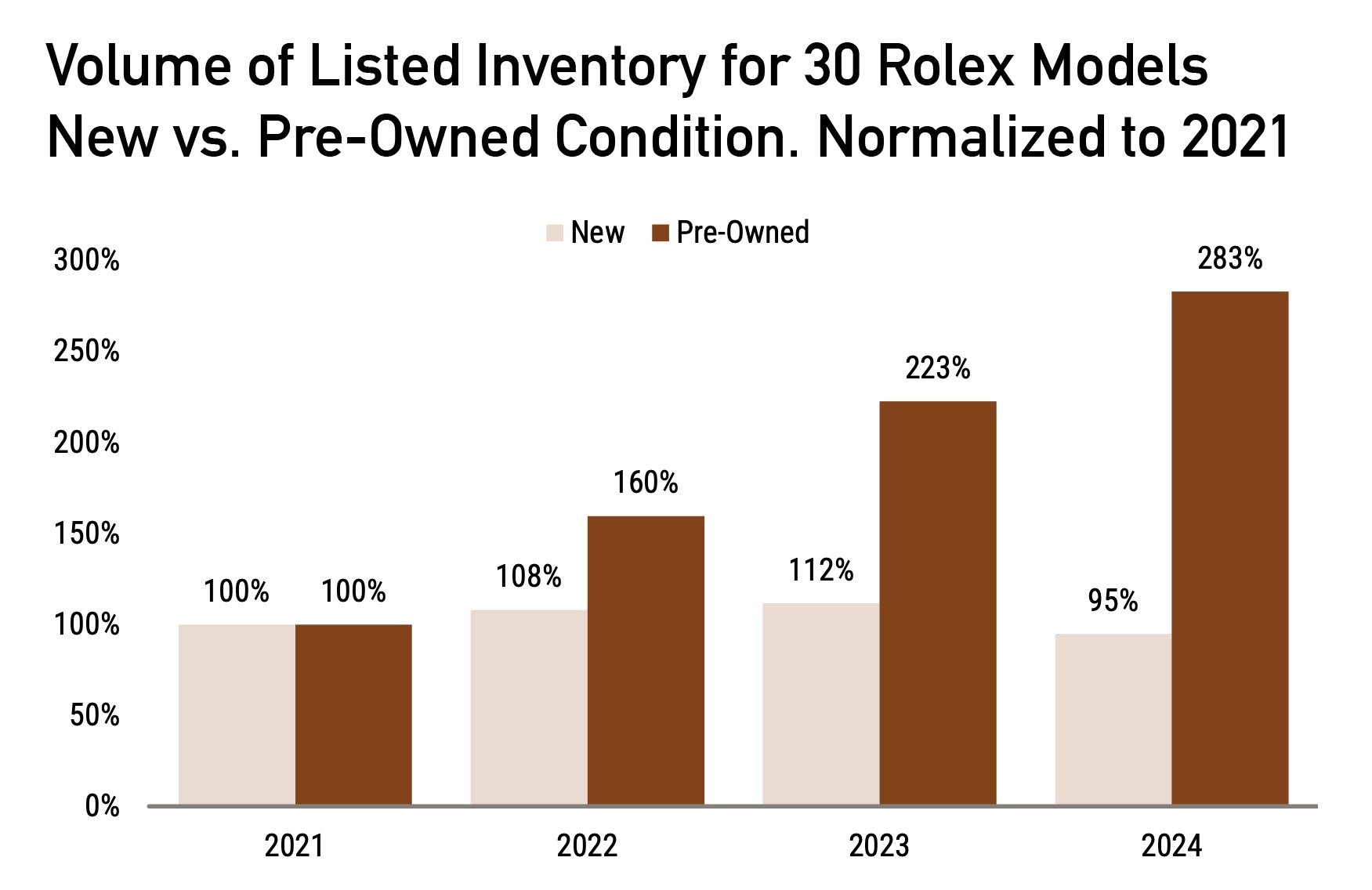

(Data: WatchCharts/Morgan Stanley)

The inventory of Rolex models sold on the pre-owned market continued to swell in 2024, according to WatchCharts’ first market report of 2025, released Tuesday in partnership with Morgan Stanley. But those listed for sale in brand-new condition declined for the first time since 2021, a sign of more flippers exiting the market.

Still, the Rolex secondary supply has reached a record high when compared to 2021, putting more pressure than ever on prices. “We see no sustainable long-term factors that would drive an eminent market recovery,” WatchCharts wrote in its analysis after tracking a set of 30 modern Rolex models.

One reason for an ever growing supply of Rolex watches is sellers holding out and unwilling to realize losses. Meanwhile, the Rolex CPO program has grown significantly this past year, with 107 retailers now participating, compared to around 25 retailers enrolled in CPO a year ago.

Among prominent pre-owned dealers, Hodinkee exited the secondary market entirely in 2024, just three years after getting into the business through its $46 million acquisition of Crown & Caliber. In Europe, Chronext entered voluntary administration after unsuccessful fundraising efforts and was acquired in Dec. 2024. Chrono24 announced today it would cut 110 jobs, almost a quarter of its workforce.

“A return to a world where most Rolex models are readily available at retail is conceivable in the next few years,” WatchCharts said.