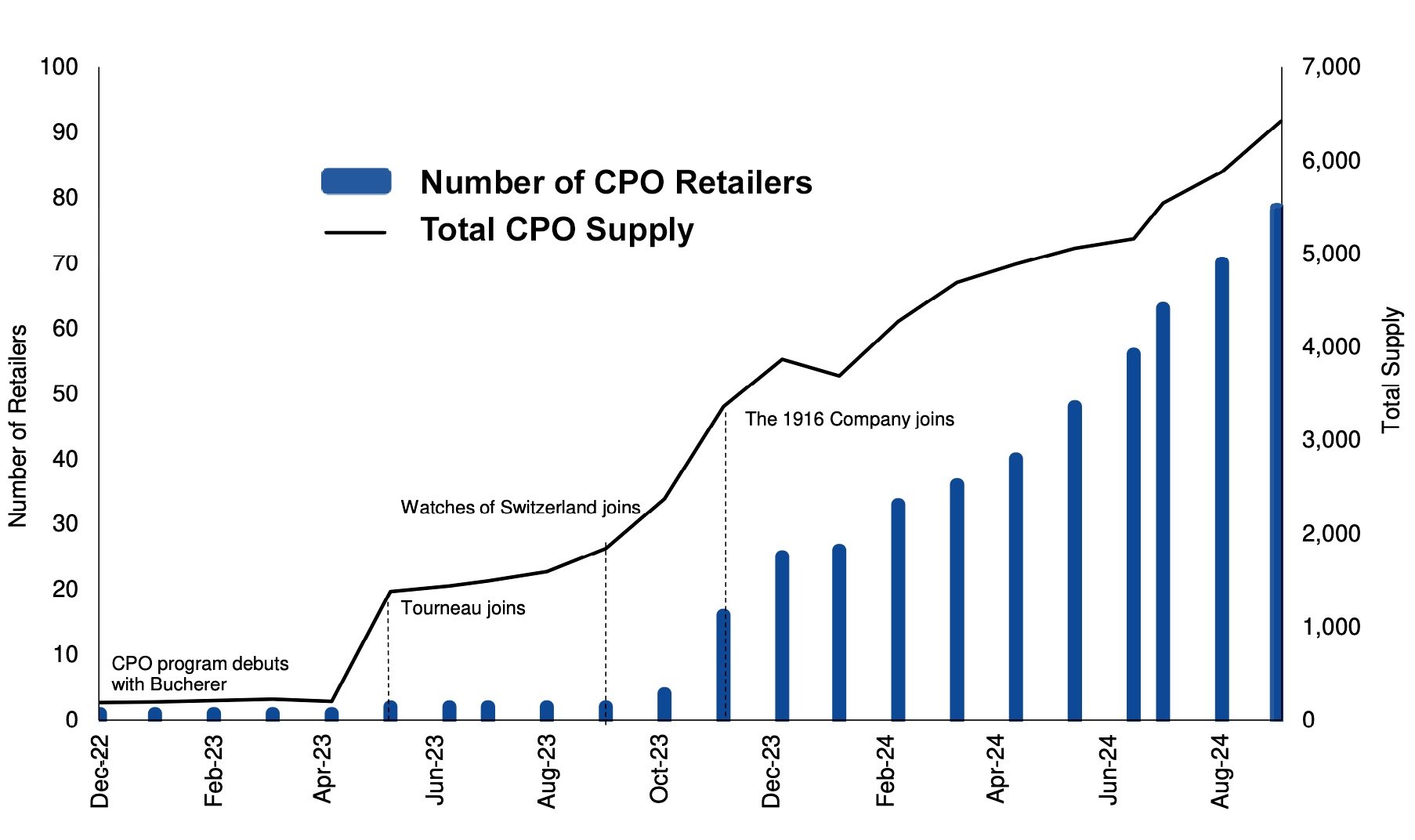

(Data: WatchCharts/Morgan Stanley)

The Rolex pre-owned market might be dropping, but the Rolex Certified Pre-Owned program continues to swell despite its premium. That's according to WatchCharts, which has just released the latest data as part of its Morgan Stanley quarterly report.

The 10-consecutive-quarter drop of the pre-owned watch market hasn't deterred more authorized dealers to join the program started by Rolex in Dec. 2022. Since last quarter, at least 17 new retailers have joined the CPO program. Today, WatchCharts estimates there are around 6,400 listings from 78 authorized retailers around the world, with a combined value in excess of $150 million, based on asking price.

(Data: WatchCharts/Morgan Stanley)

Rolex’s acquisition of Bucherer having been finalized in late July, this is the first quarter Rolex-owned boutiques sell new and pre-owned Rolex watches in the same store.

Bucherer’s CPO premium averages at +36% when compared to non-CPO dealers. Watches of Switzerland charges the largest CPO premium, +46% for the UK inventory and +42% for the US, according to WatchCharts, while the 1916 Company remains the most competitive, with an average premium of +15%.