From Independent Watchmakers to Watch Conglomerates

Christophe François von Ziegler (1855-1909), watchmaker's workshop in 19th century Geneva

First Level: Independent Watch Manufacturers

‘Independent watchmaker’ is an umbrella term used for brands which are not owned by the large luxury conglomerates such as LVMH, Richemont or the Swatch Group. Independent watchmakers have long been battling against a variety of challenges.

An issue that modern day independent watchmakers face is that they operate within a niche section of the watch sector and typically have a niche following as well. Another problem they face is economics. They need to be able to afford to produce in sufficient quantities to come down the cost curve to keep prices down for customers. If they were able to attract more buyers, they could be able produce higher quantities which would further increase profits. The demand they do receive often means juggling resources, time, and customer expectations, a tough thing to do for a small team.

Independents often struggle to justify prices low enough to attract a wide-range of buyers or drive volume high enough to cut costs. Some happen to make it work, like Rolex or Patek Philippe, which for our purposes we would consider ‘mass producers’, given the volume of watches they produce. F.P. Journe, Philippe Dufour, and Richard Mille are the typical high-end independent brands that produce a low volume of watches for very high prices. Others, like NOMOS, seem to have solved the issue, with reasonably priced, high quality timepieces.

Second Level: Mass Producers

Patek Philippe at the start of industrialization / Credit: Patek Philippe

What we will call ‘mass producers’ are watch brands that produce a high volume of standardized timepieces, be they independent or part of a conglomerate.

In the watch industry there are big players who make critical components used by other manufacturers in-house, or who buy large volumes from suppliers who depend on their business to stay afloat. This means the larger the player, the more power and influence they can exert over the industry. A great example would be ETA, that is only supplying movements to brands that are part of the Swatch Group…something that can prove devastating for the smaller players who depend on the ETA movements to survive.

Therefore, smaller operations tend to be last in line for lead times on vital products, and don’t get the volume pricing that larger players get the benefit of. Furthermore, since there is a lack of products in retail, salespeople or marketing managers for these smaller companies often have a hard time bringing these brands' stories to life for potential buyers versus those for so-called mass producers.

This pressure has historically led independent watchmakers into mass production. Part of mass production is the manufacturing of standardized products, often using assembly lines and automated technology, along with the high volumes. Production economics are highly beneficial with this approach, as the cost of given items decreases on the order of 10 to 30 percent every time production doubles. As a result of such scaling, uniformity in products started to come to daylight.

These luxury brands now release individual watch lines, complementary lines, innovate within those lines, and use the same manufacturing processes to drive those costs lower. For example, Patek Philippe released only 349 examples of the reference 2499 from 1950-1985, while they now produce over 60,000 watches annually. They went from being an independent brand that produces very few timepieces per year, to a mass producer, albeit still independent.

Third Level: The Conglomerates

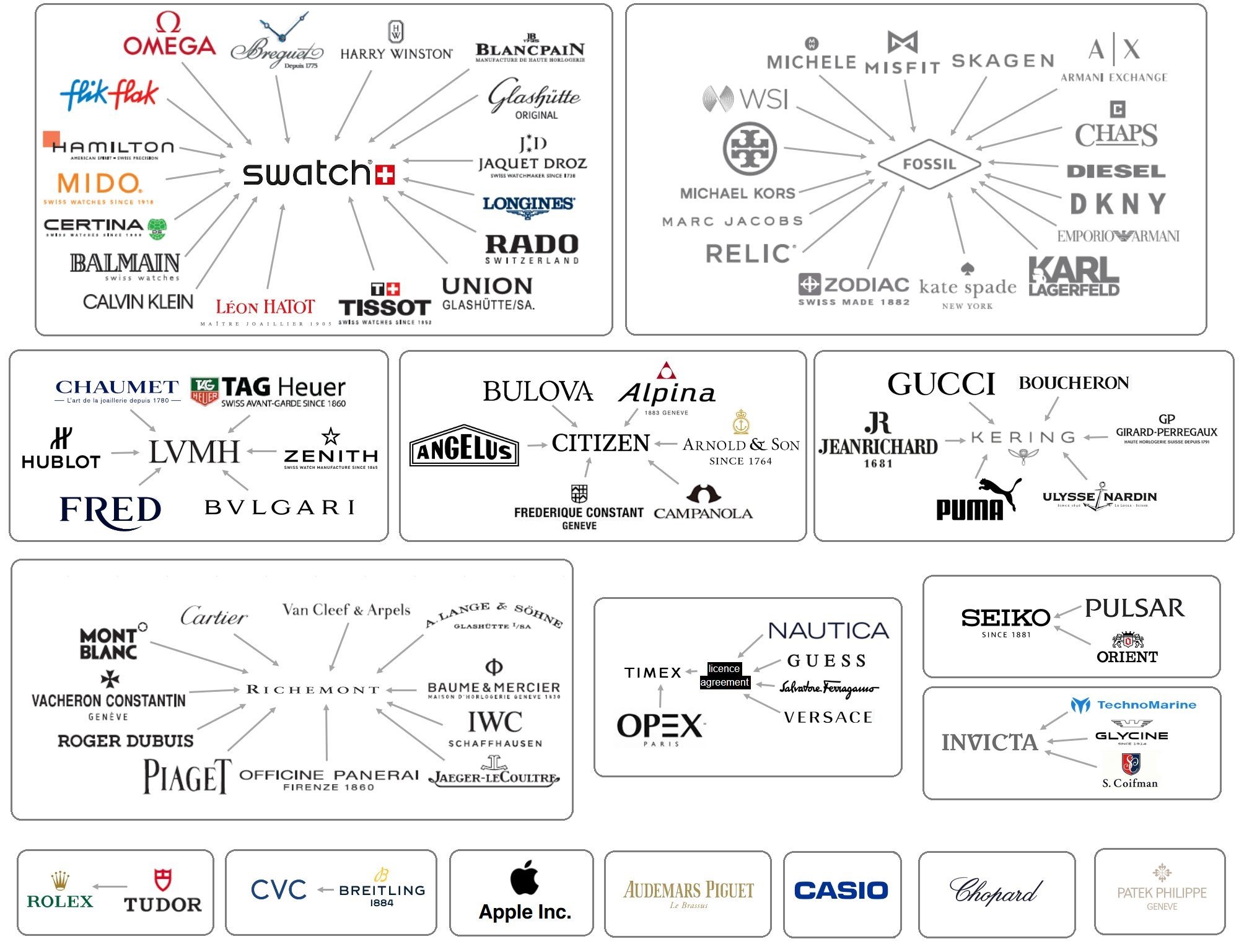

Conglomerates within the watch industry

The consolidation phase in the industry life cycle is where competitors start to merge with one another. Companies will seek to consolidate in order to gain a larger portion of overall market share and to take advantage of synergies. Historically the watch industry has seen consolidation a number of times, from the early 20th century to the 1980s when the Swatch Group rose to the top of the industry. Today companies like the Swatch Group, LVMH, Kering, and Richemont are examples of some of the most important conglomerates in the watch industry. And the majority of significant watch brands are part of one of these conglomerates. Very few, like Rolex, Patek Philippe, and Audemars Piguet, remain independent while still producing timepieces in high volume.

By: Eric Mulder