Looking at the Performance of TAG Heuer Since Bernard Arnault’s Son, Frédéric, Took Over in 2020

Frédéric Arnault and the Sold-Out TAG Heuer Connected x Super Mario Limited Edition

When Frédéric Arnault was first appointed as CEO of TAG Heuer in 2020, the move faced its fair share of criticism, as the then 25-year-old had been appointed by his father as the head of the 160-year-old watch brand. While the nepotism was obvious, and not something shareholders are usually happy with, Frédéric was also criticized for his lack of experience. Now, Frédéric Arnault has not necessarily been given free reign to do as he pleases with TAG Heuer, and as the fourth child of billionaire Bernard Arnaut, he has been working at TAG Heuer since 2017, immediately after graduation from L’X, previously focusing on the brand’s digital efforts – including smartwatches.

We wanted to look at TAG Heuer’s performance since his appointment as CEO a couple years ago, and the general trajectory that the brand is on, looking at the models they have released and at the market share that the company may or may not have gained in that time.

TAG Heuer’s Market Share

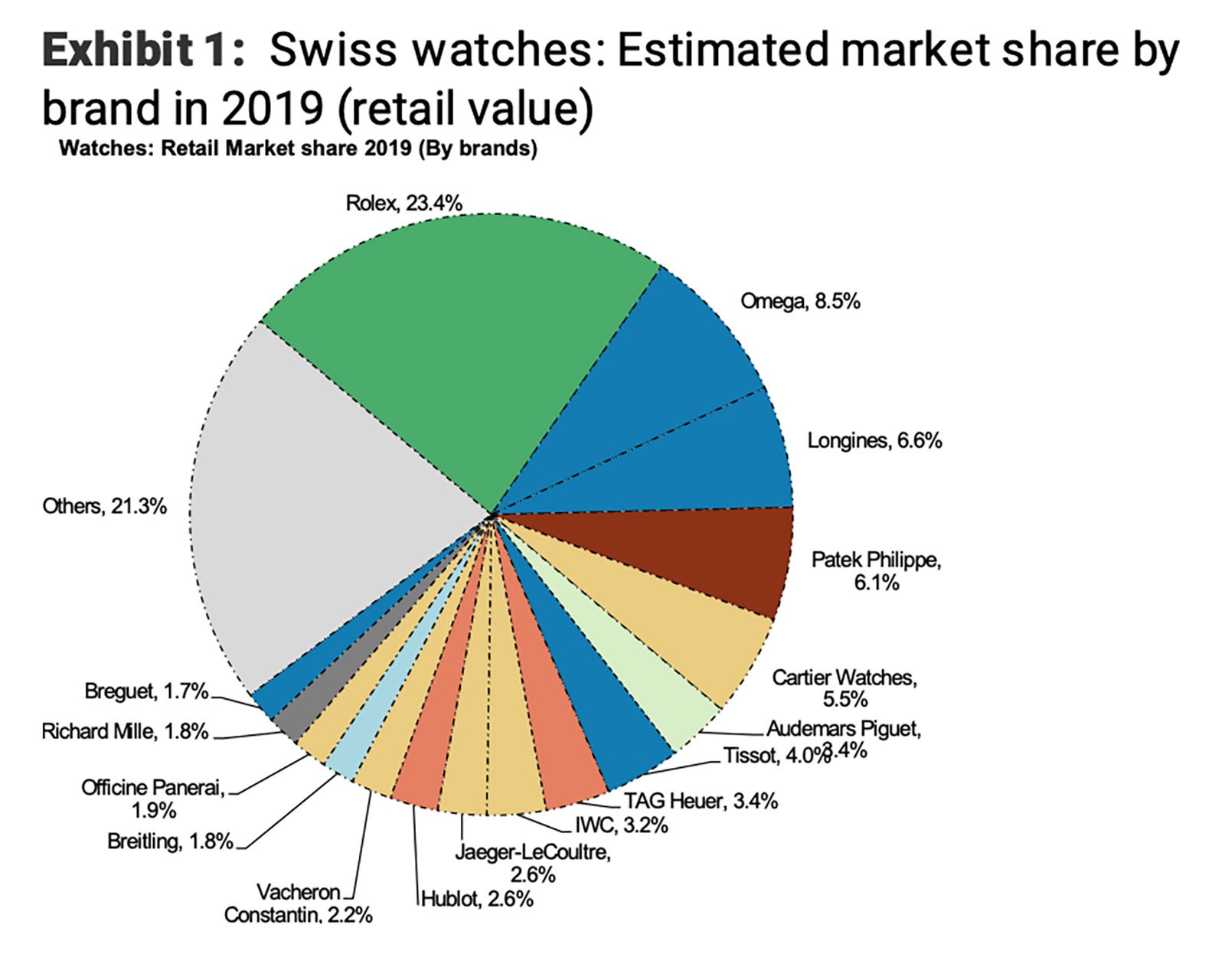

Swiss watch brands’ market share by retail sales / Credit: LuxeConsult and Morgan Stanley Research

According to LuxeConsult and Morgan Stanley Research, TAG Heuer had a 3.4% market share of the Swiss watch market based on retail value in 2019. LVMH – that has 6 brands under its umbrella – had a market share of 7.8% that same year. This means that neither TAG Heuer or LVMH are significant players when it comes to watches today. Of course, the behemoths that are Patek Philippe and Rolex tend to be on the top, along with Audemars Piguet and Swatch Group brands like Omega and Longines. TAG Heuer is, however, an iconic brand, with a highly respected history and a robust community of collectors.

Today, according to the most recent figures by Morgan Stanley for 2021, the market share that TAG Heuer commands in regards to Swiss watches and their retail sales has decreased by 2.3%. For about the last 5 years TAG Heuer has always been around 9th or 10th when it comes to sales of Swiss watch brands, so it has still maintained the same position, which means that the brands above it have just increased their sales proportionately to TAG’s. Generally, LVMH’s brands are not doing too well, with Hublot being the best performing among them – not exactly something to be proud of for those that are fans of watch memes. While revenues are increasing across LVMH’s watches division, market share is not increasing at the same pace; they’re being outsold by their competitors.

TAG Heuer’s Recent Watch Releases

TAG Heuer Carrera Plasma Tourbillon / Credit: TAG Heuer

In recent years, TAG Heuer has made a number of moves to try to reposition itself going forward. Its focus on smartwatches though their Connected line that Frédéric Arnault once called “defensive”, has since become an important part of their catalogue. They’ve also signed a new partnership with Porsche – which is fitting given TAG Heuer’s history with motorsport, and released new limited editions – like the TAG Heuer Connected x Super Mario Limited Edition watch. It seems clear the direction in which TAG Heuer is being taken, in short you could say it is going down the Hublot route or ‘selling out’. It looks like smartwatches are the future over at TAG though.

TAG Heuer Monaco Gulf Special Edition / Credit: Monochrome Watches

Generally, watch brands today that are looking to reposition themselves have two choices: they can either focus on their heritage and hone in on their true watchmaking prowess – something like Zodiac is doing with their new releases based on vintage hits like the Zodiac Super Sea Wolf. Or they can turn towards something new like smartwatches and try to compete with the likes of Apple. While pumping out homages may not be the favourite strategy of watch lovers, it is tried and true. And it is certainly preferred over the path TAG Heuer seems to be going down, which is getting away from pure horology and focusing more on smartwatches. This may prove to be financially successful, or at least keep TAG Heuer afloat, but from my purist perspective it is definitely diluting a brand that was already struggling to get respect in horological circles. In other words, I can’t imagine anyone pulling up with a modern TAG Heuer at a watch meet.

Now, TAG Heuer does, of course, still have models like the Carrera, Monaco, and Aquaracer, that keep it anchored to its roots. Including new releases at Watches & Wonders this year, however, I’d say the overall face of the brand is changing. Heuer has gone from the motorsport king up until the 1990s, to making sturdy and attractive sports watches in the 1990s and early 2000s, to now turning its focus to smartwatches and limited-edition releases. I get it, it’s hard to take a chance on a new watch model when millions of dollars are on the line, but that’s why so many brands stick to producing homages these days. Unfortunately for TAG, unlike a brand like Omega that can be anchored by models like the Omega Speedmaster and Seamaster, TAG Heuer’s modern Carrera, Monaco, and the like, never seemed to have caught on to the same extent. Which is likely why homages were out of the question – I mean who really wants to see the Heuer Kentucky get revived? So, in that lens, it seems that smartwatches were the best path forward, and perhaps the only way to keep TAG Heuer going in such a competitive market.

Conclusion

While I hate to see a brand like TAG Heuer reduced to making smartwatches, I understand the strategic necessity. However, I don’t expect to be seeing standout financial performance from the brand either. Practically speaking, it’s hard to say how much influence Frédéric Arnault really has over the strategic decisions the company makes. Being part of a group like LVMH, he still has a Stéphane Bianchi to report to, who oversees the group’s watches division, and his father, of course. When thinking of the portfolio of watch brands that LVMH owns, it might make sense to designate TAG Heuer as the resident smartwatch maker. Especially in the face of brands such as Hublot, Zenith, Chaumet, and Bulgari, that are all several levels above TAG Heuer when it comes to luxury. TAG Heuer is the ‘grunt’ of the group in terms of prestige as a traditional ‘entry-level’ luxury brand. So it's no wonder it has been positioned to compete with brands such as Tissot.

Thus, TAG Heuer’s performance has been mediocre in my opinion, but outside of a miracle, you shouldn’t have expected anything more. Instead of rallying back with new, innovative models, they have taken the smartwatch/limited edition route. And on top of that, lost market share to other brands. If TAG Heuer is to succeed in today’s market, it needs a serious rebrand. Because it is clear for anyone to see that it is only brands with decades-old, established and distinct reputations that are exhibiting strong growth today. Not brands that have gone from motorsport to ‘entry-level’ luxury to ‘luxury’ smartwatches over the past 40 years. All while increasing their prices pretty significantly, mind you.

By: Andres Ibarguen

Read more:

Müller Olivier R. “State of the Industry – Swiss Watchmaking in 2020.” Watches By SJX, March 12th, 2020, https://watchesbysjx.com/2020/03/swiss-watch-industry-report-2020.html.

Müller Olivier R. ``State of the Industry – Swiss Watchmaking in 2022.” Watches By SJX, March 8th, 2022, https://watchesbysjx.com/2022/03/morgan-stanley-watch-industry-report-2022.html.